WEDNESDAY, SEPTEMBER 23, 2015

Most of us probably remember the massive information breach at Target in late 2013. For many who shopped at the mega retailer between November and December 2013, the holidays weren't so merry that year as their personal information was compromised. It's estimated that some 70 million records were stolen in the breach, which resulted in $40 million stolen from the company.

As of January 2015 it spent $252 million in costs related to the data breach, which was partially offset by $90 million in insurance coverage.

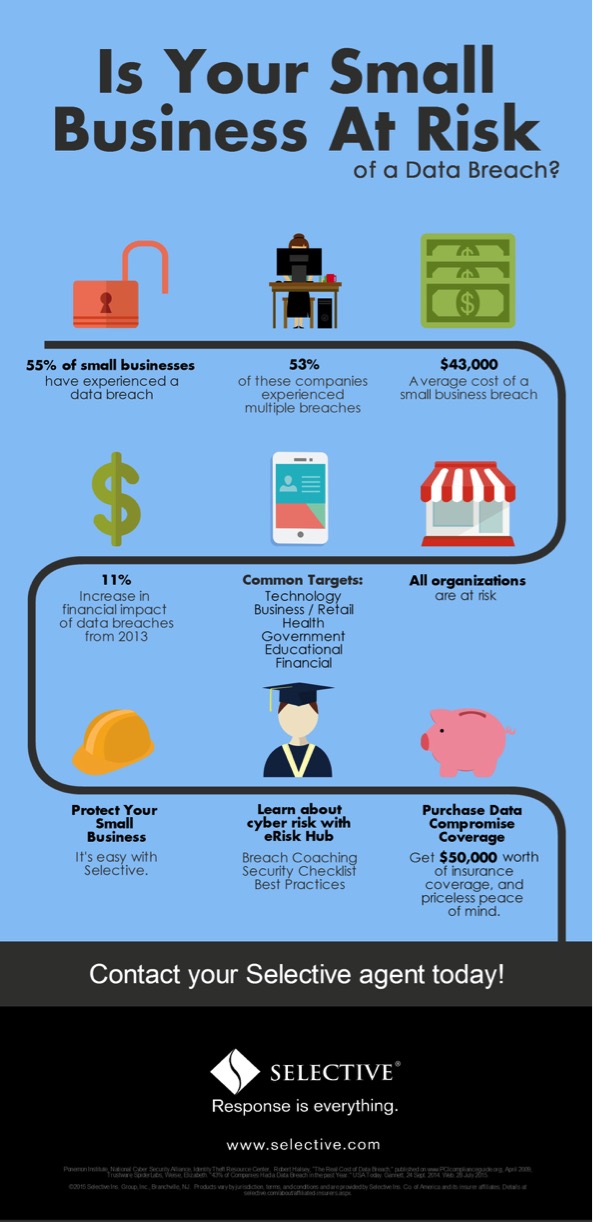

This is every business owner's worst nightmare -- but there are steps you can take to protect your company (even if you own a small business!).

Cyber liability cover a business' liability for a data breach in which the firm's customers' personal information, such as Social Security or credit card numbers, is exposed or stolen by a hacker or other criminal who has gained access to the company's electronic network. And, in the age of wireless communications, social media, and tablet computing, conducting business electronically is the norm -- so cyber liability is something every business owner should have.

For example, say you're an online retailer that sells from a variety of vendors. You have a virus in your computer that causes your website to go down for a day. You could be sued by one of your vendors for loss of income during the down time.

Or, perhaps your company moves offices -- and your HR department misplaces a box of former employees' personal files. You could be looking at thousands of dollars of loss due to fraud assistance, public records monitoring and notifying employees of the breach -- and that's not taking into consideration being sued by an employee.

So, cyber liability covers large-scale breaches like Target -- and issues that can hurt smaller companies, too. Selective’s CyCurity insurance provides three coverages designed to help protect your business if you experience a cyber loss: electronic media liability, electronic information security liability and security breach expenses.

EK Agency offers CyCurity, and can customize a plan to suit your business's needs! There are trolls, hackers and viruses lurking on the Internet, waiting to pounce on any opportunity. Don't let it happen to you!

Source: 1. Inc., 5 Reasons You Should Have Cyber Liability | 2. Krebs on Security, The Target Breach, By 'the Numbers.

Photo credit: Selective.com | Perspecsys Photos, Cyber Security - Tablet.

Posted 11:00 AM Tags: ek agency, cyber liability, small businesses, business owners, protection, company, insurance for businesses, insurance agent, hackers, internet, target breach, cycurity

NOTICE: This blog and website are made available by the publisher for educational and informational purposes only.

It is not be used as a substitute for competent insurance, legal, or tax advice from a licensed professional

in your state. By using this blog site you understand that there is no broker client relationship between

you and the blog and website publisher.

|

Blog Archive

2023

2021

2020

2019

2017

2016

2015

2014

2013

2012

2011

|